Category Archives: Featured

Featured content about company formation in Hungary, accounting and tax compliance

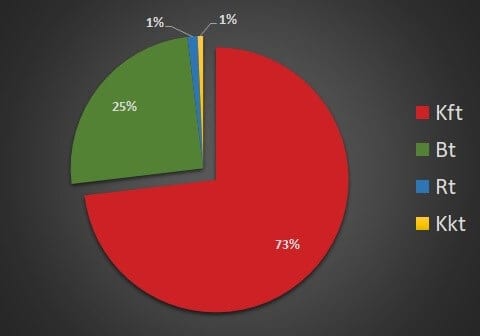

Types of companies in Hungary

Types of companies in Hungary

When you decide to open a new company in Hungary and enjoy the benefits of the Hungarian economic environment you will probably face the question: what type of company suits me the best? The most popular is opening Kft company – but do you know what are your other options? In this article you will find an overview of the available company types in Hungary.

Based on Act on investments of foreigners such regular, profit oriented, risk-bearing business operation can be carried out in Hungary through an establishment, which can be:

- self-employment

- commercial representation

- branch office

- business organisation (ie. company)

1. Companies

1.1. Limited Liability Company

Limited liability companies (korlátolt felelősségű társaság – Kft) are business associations founded with an initial capital consisting of capital contributions of a pre-determined amount. The obligation of members to the company extends only to the provision of their capital contributions, and to other possible contributions as set forth in the articles of association. Members shall not be liable for the obligations of the company.

Membership rights are represented by so-called “business quotas”, which is listed solely in members’ list of the company. Voting and dividend rates may differ from shareholding rates of the members.

The private limited liability company is managed by at least one managing director, whose right to represent the company may be individual or joint with other directors or employees. In-kind contributions are allowed up to the full amount of the share capital.

Other special features regarding a limited liability company:

- Minimum share capital of HUF 3,000,000 is required

- Contributions to the share capital may be contributed in the form of cash or in-kind contributions

- Additional capital can be contributed to ‘Capital reserve’

- Two obligatory bodies – General Meeting, Executives

- Supervisory Board facultative

- Annual financial statements need to be disclosed

- Bank account is obligatory

- Annual audit is required if criteria are met (turnover, number of employees)

In conclusion opening Kft company is the most popular if we consider the easy company formation, relatively low capital requirement, and liability requirements.

1.2. Joint stock company

The joint stock company in Hungary (rt.) can be private (zrt.) if its shares are not listed to the public or public (nyrt.) if it is listed on the Stock Exchange. An important difference between the two also lies in the minimum share capital necessary at the incorporation: 5 million HUF for the private one and 20 million HUF for the public joint stock company. This company can be opened by one or more founders and a board of directors must oversee the actions of the company.

- Public joint companies need four obligatory bodies – Board of Directors, General Meeting of Shareholders, Supervisory Board, Audit Committee

- Public joint stock companies have annual audit requirement

- In case of private joint stock companies Supervisory Board shall be established only upon the request of shareholders with at least five percent of voting right. Audit Committee is not compulsory.

- Private joint stock companies have annual audit requirement once the criteria are met (turnover, assets, number of employees)

2. Partnerships

2.1. General Partnership

Individuals who wish to carry out business activity max form general partnership (közkereseti társaság – kkt.) The liabilities of the members are joint and unlimited, and consequently partners in such a company are liable for a breach of its obligations with all the partners’ assets and property (general liability). There is no minimum capital set out, and at least one member is required to form this company.

2.2. Limited Partnership

Limited partnership (Betéti társaság; Bt) needs minimum two founding members to establish the company. At least one of the members has unlimited liability, while at least another one partner has liability limited to the extent of his capital contribution.

There is no minimum capital requirement.

3. Enterprise of Branch Offices of Foreign Entity

The branch office (Fióktelep) can be suitable for foreign companies that want to open an office in Hungary and comply with the requirements for bearing full liability for the branch. Branch office has no legal personality, can carry out business activities in Hungary as division of the founding member. Registration with the Court of Companies is necessary, head of branch needs to be appointed who can be employee of any nationality, or can be mandate of Hungarian nationality. Branch offices have several taxation and accountancy specialities that require different treatment from general administration.

Company Portal: register your companies

There has been a couple of weeks passed on since the latest administration nuisance: Company Portal registration became available, and we released our first news about. Below we give a more detailed overview of Company Portal administration.

What’s it good for?

Company Portal is an official storage space available to business organisations. According to the government plans it launches on 1 January 2018. This will provide official space for communication with government bodies, municipalities, authorities, courts and utility companies – in the spirit of simplifying administration.

„Company Portal management is the sole and clear responsibility of each company and its directors”

But why is it necessary if I already have magyarorszag.hu Client Portal access and my tax affairs go through that? Or if my accountant / tax adviser deals with this?

The reason is that the Company Portal will be assigned to the company or business organisation; while Client Portal is linked to individual privates. Accordingly, communication through Company Portal means communication with the company, while communication through Client Portal means communication with an individual person. Apparently Company Portal will create a clear and direct electronic communication line to the company.

Being said that it is also expected that types of affairs administrable via Company Portal will get extended in the future.

Who needs to use Company Portal?

Business organisations, which include companies, branch offices of foreign companies, and moreover civil organisations like associations, cooperatives, legal offices, foundation.

Sole entrepreneurs will not switch to Company Portal, but still use their Client Portal.

Subsequently all business organisations need to register themselves for the Company Portal service. This is to be done by 30 August 2017 or by latest 31 December. Missing registration by the end of August won’t result in any sanctions.

Companies may register by entering their email availabilities for electronic communications.

Note that registration can be executed by such a natural person who already has access to Client Portal or has electronic id card. If there’s no such representative, then the first step is to register someone by visiting the government office in person.

At the same time, it has been confirmed that Company Portal registration can be executed by a representative owning proper POA document. These can be such as lawyers, administrators, company secretaries, accountants or tax advisers.

The document of authorisation shall be attached at registration, and registering person shall declare with criminal responsibility that documents are true and valid.

This can be an alternative solution for non-Hungarian resident directors who usually don’t have Client Portal access.

What roles are there?

There are different roles in Company Portal.

The company representative or „cégképviselő” is the person who executes the registration, and his role ends here.

Each company representative shall appoint a person who will manage Company Portal and permissions – he’s the company portal administrator or „cégkapumegbízott”

Later on you can appoint Company Portal users who will be able to send and receive documents in the future. At larger companies appointments shall be made carefully.

Finally it’s very important to emphasize that you need an already operative email address. This will be required during the registration procedure. Bear in mind that you will need to keep an eye on the notifications arriving to that particular email address.

Where can I register for Company Portal service?

Registration can be done here: cegkapu.gov.hu

Final thoughts

We cannot emphasize enough that Company Portal registration and Company Portal management is the sole and clear responsibility of each company and its directors, as official company communications will go through this channel.

We BSPL are not providing secretarial services to our clients. Accordingly we are not able to accept appointments to Company Portal management.

CEGKAPU: mandatory registration to all companies

Registration

Attention: new company administration task to register for company gate by 30 August 2017 – a new legislation suggests.

Hungarian legislation lays down requirement for all business organisations to arrange their official affairs through a safe, secure and verified electronic connection with government offices and utility companies.

According to new government regulation business organisations shall use the brand new CEGKAPU (company gate) government operated service. Registration is expected by 30 August 2017. Further as from 1 January 2018 official affairs shall be managed only through CEGKAPU .

CEGKAPU will be an online storage space which holds an email address of the particular company via which official communication can be carried out. This service will be used as primary means of communication between companies and government bodies, municipalities, bailiffs and utility companies.

Accordingly as a new company administration tasks all business organisations shall perform registration to CEGKAPU.

Technical todos

All business organisations shall have one CEGKAPU. Natural persons (cegkapu proxy) with authority at the given company, or any other persons with proper authorisation are entitled to use Cegkapu.

Registrator person shall register one and only company gate administrator. Company gate administrator can register further persons entitled to use company gate. They will be company gate users.

Users will register for the service through an online interface available at https://cegkapu.gov.hu/ and can be done by the official representative of the particular company.

Registrators shall be safely identified. Available identification methods are: Ugyfelkapu; Code based identification via telephone; Electronic ID card.

Proper PoA shall be attached to registration form as proof of right for registration.

Don’t forget

Register your company for CEGKAPU by 30 August 2017.

Local tax, local business tax

Besides corporate tax there is also another profit based tax in Hungary, the so called local tax.

Town municipalities levy and collect local taxes as to contribute to municipality liabilities. While in opposition: corporate tax is collected by central government.

There are four main classes of local taxes: local business tax; property tax; tourism tax; and communal tax. All business meet local business tax. This one is the general local tax payable after operating in the area of the municipality. Property tax is payable by those enterprises that own land or building. Companies offering accommodation (hotel or hostel operators) collect tourism tax from their guests, and pay it to local government. Communal tax is only payable by privates.

Hereinafter you will learn about local business tax only.

Local business tax base and rate

Local business tax is payable not after total profit, but rather after gross profit. The basic concept of the tax calculation is: net turnover – allowed expenses.

Allowed expenses include: material purchases’ costs, cost of goods sold and cost of services sold (forwarded services).

Local tax is levied by the town where the company operates at a maximum tax rate of 2%. Local municipalities decide on their own about the effective tax rate valid in the area of the town, however despite this option they rarely offer reduced tax rate.

Tax reporting and payment

Your accountant will report this tax annually by the end of May, in line with general year-end closing deadline.

You’ll need to pay advances based on prior year tax and in two instalments. First payment is due by 15 March and second on 15 September. Those larger taxpayers whoose net sales income exceeded HUF 100 million in prior year are to top-up their tax to full annual tax by 20 December. In the annual tax declaration advance payments and top-up are settled against annual tax.

Business phone and private usage

Business phone

As a company owner or manager it’s worth knowing that telephone services will imply significant extra costs if you don’t pay attention.

The law by default assumes there was private usage, and this does prohibit deducting the VAT of the expense.

For this reason the VAT act applies the 70% rule on deductibility: meaning that 30% of the input VAT of the phone expense is non-deductible. An additional headache is that the Personal Income Tax act assumes private usage of the company phone.

If the company phone was used for private purposes, then the business and private usage needs to be separated item-by-item, and the VAT amount of the private usage is non-deductible at all (neither partially nor proportionally).

If the itemized separation is impossible, then 20% of the full phone cost is deemed to be private usage.

Private usage – whichever version the company chooses – is a fringe benefit and taxable accordingly: the tax base is 1.19 times the amount calculated as above. The personal income tax is 16 percent, and additional 27 percent helath care contribution arises. Alltogether quite unfavourable 51.17% tax burden comes up, and this shall be paid by the company.

There’s one release from non-deducting the VAT: if the company forwards at least 30% of the incoming cost then the full amount of the VAT is deductible.

Hint: if you forward 30% of the incoming phone bill’s amount to the employees, then the VAT becomes fully deductible, and either fringe benefit or its taxes won’t even arise.

Hungarian VAT essentials

Basic information

The value added tax is called „Általános forgalmi adó” or simply „Áfa” in Hungarian.

Hungary is a member state of the European Union.

Non-Hungarian entities are required to register for Hungarian VAT if they perform business transactions in Hungary.

The main source of Hungarian VAT regulations is Act CXXVII of 2007 on value added tax (hereinafter VAT Act), which is in line with the VAT directive of the EU.

Registration

All companies shall register at the central tax office for VAT number. EU VAT number can be obtained easily.

There is no threshold for VAT registration.

VAT rates

Currently there are three VAT rates in Hungary:

- 27% standard rate – applicable on all goods and services sales unless otherwise specified

- 5% and 18% reduced rates

- 0% on exempt transactions

Examples of exempt supplies of goods and services

- Financial services

- Insurance

- Public postal services

- Approved education

- Lease of property

- Sale of securities

- Sale of lease of land

- Human medical care

- Folk arts and crafts

VAT return periods

- quarterly: general reporting period

- monthly: all newly formed companies in the year and the subsequent year of their formation, and if net VAT payable in the tax year or in the second year preceding the year in question exceeds HUF1 million; or if VAT grouping is applied

- yearly: If net tax payable or reclaimable in the second year preceding the year in question did not exceed HUF250,000 and if the taxpayer does not possess an EU VAT number

Time of supply

The time at which VAT becomes due is called the “time of supply” or “tax point.” With some exceptions, the time of supply is deemed to be when the supply is made or when an invoice is issued.

Prepayments and deposits

Prepayment or deposits qualify as „time of supply” when the payment is received. The amount is considered to be inclusive of VAT. When a reverse charge applies between domestic taxpayers, the prepayment shall not be deemed as a tax point as it is with intra-Community acquisitions and supplies of goods.

If a Hungarian taxable person makes a prepayment with respect to services purchased from other EU Member States or third countries (that fall under the reverse-charge mechanism), the amount shall be regarded as being exclusive of VAT and the Hungarian taxable person is required to self-charge the VAT on the advance payment it paid.

Installments and periodic settlements

The supply of goods and services may be invoiced periodically in line with the agreement of the parties, or the consideration may be paid in installments. In these cases the tax point is the due date of the payments.

As from 1 January 2016, the tax point of these transactions will be taxable on the last day of the settlement period, except for telecommunication and utility services, which will be still deemed taxable on the due date.

Intra-Community purchases

The time of supply for intra-Community acquisitions of goods is the date of issuance of the invoice, but not later than the 15th day of the month following the month in which the transaction takes place. For services, it is the date on which the supply is made.

Imported goods

The time of supply for imported goods is either the date of acceptance of the customs declaration or the date on which the goods leave a duty suspension regime.

Cash accounting

From 1 January 2013 the Hungarian VAT system implemented a cash accounting method. This may be applied by the following taxpayers:

- Taxpayers that qualify as small enterprises on the first day of the year based on the relevant act, or that would qualify as small enterprises if they were subject to the relevant act

- Taxpayers that have a fixed establishment in Hungary or, in the absence of a fixed establishment, a permanent address or place where they usually reside

- Taxpayers for whom the sum of both the expected and the actual consideration in a given year does not exceed the equivalent of HUF 125 million (approximately EUR 420,000)

Taxpayers may opt for cash-based taxation for domestic transactions subject to VAT, but considerations for supplies that are outside the scope of Hungarian VAT and for supplies subject to the reverse charge regime are also included in the threshold. Revenue deriving from the sale of tangible assets, from the assignment of intangible property on a permanent basis, from intra-Community supply, from certain VAT-exempt supplies and from services ancillary to financial services is not considered when applying the threshold.

New companies must meet the financial conditions proportionately.

Taxable entities applying cash-based taxation shall indicate this taxation method on their invoices.

Taxpayers under cash-based taxation have to pay output VAT upon receipt of the consideration, and are entitled to deduct input VAT when they pay the total gross amount of the invoice.

Taxpayers receiving invoices from suppliers that apply cash-based accounting scheme can deduct the input VAT only at the time they pay the consideration (including the VAT) to the supplier.

Taxpayers may decide to terminate the application of cash-based taxation from the year following the current tax year.

Cash-based taxation will be terminated automatically if a taxpayer’s revenue exceeds the threshold or if the taxpayer is subject to insolvency or discontinuation of operations proceedings. The termination of this taxation method must be announced to the tax authority within 15 days.

Recovery of input tax

A taxable person may recover input tax, which is VAT charged on goods and services supplied to it for business purposes.

Input VAT is non-deductible for the following goods and services:

- engine fuel;

- other fuels necessary to operate passenger cars;

- 100 percent of the preliminarily charged tax on other products and 50 percent of the preliminarily charged tax on services necessary for the operation and maintenance of passenger cars;

- passenger cars;

- motorcycles above 125 cm3 cylinder capacity;

- yachts;

- residential properties; products and services for the building and renovation of residential properties;

- food and beverages;

- taxis;

- parking service;

- road use service (toll);

- catering and restaurant service;

- 30 percent of the VAT of phone service.

Requirement for invoices

Under the Hungarian VAT system upon the sale of any product or service an invoice shall be issued. This cannot be done simply in Word or Excel, but strict compliance is required to the rules set out in the law. For invoicing purposes Hungarian companies shall use either “invoice booklet” (“számlatömb” in Hungarian) or an invoicing software application. The software must comply with special Finance Ministry decree for the compliance of which the vendor of the software must issue a declaration. Application of invoicing software shall be declared to the tax office. Invoices can be issued either in the Hungarian or any spoken foreign language (Hungarian translation may be required by the tax authority); receipts must be issued in Hungarian.

- heading: “Invoice” (“Számla”)

- invoice number (there is a strict obligation to have a flowing numbering – invoices of the Hungarian VAT registration of the Company should be separate and continuous)

- name, address and tax identification number of the issuer (in the case of intra-Community transaction the Community tax number shall be indicated on the invoice. In addition the group tax ID if applicable.)

- name, address of the customer and its tax number, if the customer is liable to pay the VAT on the transaction, for intra-Community transactions the EU VAT number shall be indicated on the incoice

- date of issue of the invoice

- date of supply, if other than the date of issue of the invoice

- description of the goods or services; the statistical classification number, to the extent required for identification to use a tax rate different from the general one

Branch offices and commercial representative offices of foreign business associations in Hungary

Branch offices

In this article you will learn about two special business organisations that are available in Hungary for foreing companies to carry out business activity. These business organisations differ from the common forms of companies, however may easily be suitable for several foreign enterprises.

1. Branch offices

Foreign entrepreneurs may conduct their business in Hungary by opening a branch office in the country. Such a branch office is a separate organisation unit of the foreign business association without legal personality registered by the Hungarian court of registration. Through their branch offices, foreign business associations are entitled to carry out business activities in Hungary and are represented towards the authorities and third parties by their branch offices. The branch office has full legal capacity, it acquires rights to the benefit of and assumes liabilities for the foreign enterprise under its own company name.

Each branch office shall be registered to the company registry. Branch offices may be represented by natural persons employed at or assigned to the branch office or with a permanent contract of employment and a domestic place of residence. Representatives of branch offices and their close relatives may only conclude transactions within the activities of the branch office if the deed of foundation of the branch office or the foreign business association approves it. The foreign company’s approval is needed if the person authorised to represent the branch office intends to acquire shares in another business association conducting the same business activities as the branch office, excluding the buying of shares in public limited companies.

The laws applicable to companies with domestic registered offices apply to the business activities and the domestic business behaviour of branch offices, and its books shall be kept in accordance with the Hungarian laws on accounting. Special rules apply to the branch offices of foreign businesses conducting financial activities. The employees of the branch office are in employment relationship with the foreign business association and employer rights are exercised by the foreign business association through its branch office.

The foreign business association shall continuously provide the assets necessary for the operation of the branch office and the settlement of its debts. No permit is required for a business association registered in an EEA member state to purchase real estate required for the business operations of its Hungarian branch office. In all other cases a permit is required unless otherwise specified by an international agreement or no such property may be purchased based on the principle of reciprocity.

The foreign company and the branch office bear joint and several liability for debts incurred during the activity of the branch office. When judicial enforcement to collect debts is initiated against the foreign company, all its assets in Hungary become subject to enforcement. Enforcement procedure may also be initiated directly against the branch office, and creditors can enforce their claims even in a liquidation procedure initiated against the foreign business.

The branch office is terminated by being deleted from the company register. Deleting a branch office does not in all cases require its being free from public debt, the publication of an announcement about the termination, or verification that there are no authority or court procedures in progress against the foreign company in Hungary with regards to its activities conducted through the branch office. If the country of registration of the foreign company and Hungary have signed an international agreement on the competences of courts, the enforcement of court rulings and the collection of public debts for civil and commercial cases, or in the event such issues are governed by EU community laws.

2. Commercial representative office

Commercial representative office is an organisational unit of a foreign company without a legal personality, which can operate from the time it is registered in the company register. The scope of activities of commercial representation offices are limited to mediating and preparing contracts and carrying out information, advertising and propaganda activities on behalf of the foreign company.

In their own names, commercial representative offices may not conduct business activities that yield profits or other proceeds; however, they can conclude contracts related to their operation in the name and for the benefit of the foreign company.

The same employment rules apply to commercial representative offices as to branch offices.